EVEN-UP SAVINGS FAQ's

Frequently Asked Questions about Even-Up Saving

How do I sign up for an Even-Up Savings account?

- First you have to be a member! Once you are a member, you will need to open a Radiant Credit Union checking account and you will need a Radiant Credit Union VISA® Debit card. Once you have your checking account and debit card, you can sign up for the Even-Up Savings account online, over the phone, at a teller window, or with one of our member service representatives.

What accounts are eligible for the Even-Up Savings account?

- Any Consumer or Trust account is eligible. Business Accounts and Non-Entity accounts such as Estate Accounts are not eligible.

How does Even-Up Savings account work?

- Even-Up Savings is a savings account that works with your debit card. When you make a purchase with your Radiant Credit Union consumer debit card, the Even-Up Savings programming will round up each purchase to the nearest dollar and transfer that amount from your checking to the Even-Up Savings share each day.

- For example:

purchase made for $9.23: $9.23 + $.77 = $10.00

purchase made for $120.88: $120.37 + $.63 = $121.00

$.77 +$.63 = $1.40

$1.40 will be transferred to the Even Up share that night.

Does the Even-Up Savings amount come out at the same time as the debit card purchases?

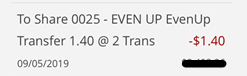

- No. The Even-Up Savings programming does not run real time and therefore will not come out at the same time the debit card purchase is withdrawn. The programming will look at every debit card purchase withdrawn for your checking share and then Even-Up Savings each purchase and perform one transfer. It should look similar to this:

Can I add any money to my Even-Up Savings share?

- No. No additional deposits are allowed outside of the transfers made in the programming.

Can I withdraw from my Even-Up Savings share?

- Yes! You can withdrawal from your Even-Up Savings at any time without penalty but Reg D limits do apply.

Can I Opt-Out of the nightly transfer?

- Yes! If for any reason you would like to turn off the nightly transfer, a Radiant Credit Union representative can process your request. You can still keep the share and it will continue to earn dividends (if there is a balance). You can Opt-In at any time and the nightly transfers will begin again.

Can I Opt-Out a specific debit card?

- No. All debit cards on the account are included in the Even-Up Savings programming. We cannot opt-out specific cards.

My Even-Up Savings processing didn’t work last night. Why?

- There could have been a couple of reasons. One, you or another account owner may have asked to Opt-Out of the night processing. Or, if your Available balance was less than $25.00 when the programming ran, it would have not transferred the funds.

Which transactions are included?

- All Signature and PIN transactions are included.